In the U.S., Social Security benefits are only designed to replace about 40% of the average worker's wages during retirement. do), it is generally a bad idea for most due to the sheer difference between a working income as opposed to the Social Security benefits.

While it is somewhat possible to retire with nothing in savings and to rely solely on Social Security (which an unfortunately significant number of Americans in the U.S. One of the most important factors that affect a person's decision to retire is whether it is even financially possible in the first place. However, it generally occurs between the ages of 55 and 70. Some announce retirement and enter it short-term, just to rejoin the workforce again. Some may choose to "semi-retire" by gradually decreasing their work hours as they approach retirement. Theoretically, retirement can happen during any normal working year. Age is also a factor that affects a person's decision to retire. Also, stressors associated with an occupation can become too unbearable, leading to a decline in satisfaction with work. Physical or mental health can affect a person's decision to retire if a worker is not physically strong enough, succumbs to a disability, or has mentally declined too much to perform the duties of their job, they should probably consider retiring, or at the very least try to find a new occupation that better accommodates their health. There are many factors at play that ultimately affect a person's decision to retire. To retire is to withdraw from active working life, and for most retirees, retirement lasts the rest of their lives. Related 401K Calculator | Roth IRA Calculator | Investment Calculator This calculator estimates how long your savings can last at a given withdrawal rate. This calculation estimates the amount a person can withdraw every month in retirement.

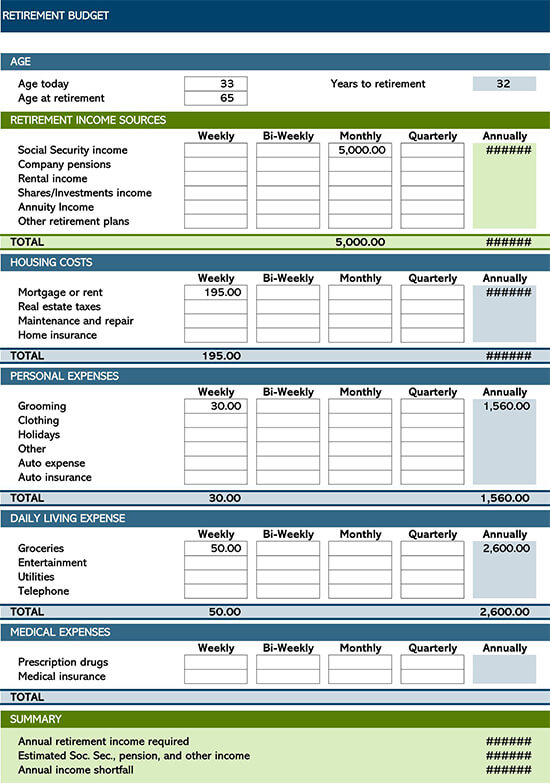

How much can you withdraw after retirement? This calculation presents potential savings plans based on desired savings at retirement. This calculator can help with planning the financial aspects of your retirement, such as providing an idea where you stand in terms of retirement savings, how much to save to reach your target, and what your retrievals will look like in retirement.

0 kommentar(er)

0 kommentar(er)